| | ||||||

|

| About sponsorship |

| |

| |

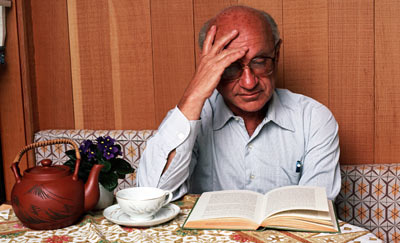

IN 1946 two American economists published a pamphlet attacking rent controls. “It was”, recalled one of them many years later, “my first taste of public controversy.” In the American Economic Review, no less, a critic dismissed “Roofs or Ceilings” as “a political tract”. The same reviewer gave the pair a proper savaging in a newspaper: “Economists who sign their names to drivel of this sort do no service to the profession they represent.”

The reminiscing author was Milton Friedman, who died on November 16th, aged 94. In the wake of the Great Depression and the second world war, with the Keynesian revolution still young, championing the free market was deeply unfashionable, even (or especially) among economists. Mr Friedman and kindred spirits—such as Friedrich von Hayek, author of “The Road to Serfdom”—were seen as cranks. Surely the horrors of the Depression had shown that markets were not to be trusted? The state, it was plain, should be master of the market; and, equipped with John Maynard Keynes's “General Theory”, governments should spend and borrow to keep the economy topped up and unemployment at bay.

That economists and policymakers think differently now is to a great degree Mr Friedman's achievement. He was the most influential economist of the second half of the 20th century (Keynes died in 1946), possibly of all of it. In 1998, in “Two Lucky People”, the memoir he wrote with his wife, Rose, he could claim to be “in the mainstream of thought, not, as we were 50 years ago, a derided minority”, and no one could dispute it.

Perhaps Mr Friedman became not only a great economist but also an influential one because he had a love of argument. As a boy he liked to make himself heard. He claimed to have had few memories of a school which he attended in Rahway, the New Jersey town his family had moved to when Brooklyn-born Milton was 13 months old, but he remembered getting a nickname. “I tended to talk very loud, indeed shout”; so when someone mentioned the proverb “Still water runs deep”, he was dubbed “Shallow”.

His classmates could scarcely have chosen a less apt moniker. Directly or indirectly, Mr Friedman brought about profound changes in the way his profession, politicians and the public thought of economic questions, in at least three enormously important and connected areas. In all of them his thinking was widely regarded at the outset as eccentric or worse.

The first of those areas is summed up by “Capitalism and Freedom”, the title of a book published in 1962 (see our review). To Mr Friedman, the two were inextricably intertwined: without economic freedom—capitalism—there could be no political freedom. Governments, he argued, should do little more than enforce contracts, promote competition, “provide a monetary framework” (of which more below) and protect the “irresponsible, whether madman or child”.

To show where Mr Friedman thought the limit of the state should lie, the book lists 14 activities, then undertaken by government in America, “that cannot...validly be justified” by the principles it lays out. These include price supports for farming; tariffs and import quotas; rent control; minimum wages; “detailed regulation of industries”, including banks; forcing pensioners to buy annuities; military conscription in time of peace; national parks; and the ban on carrying mail for profit.

Although the state still does a lot of this, it does less than it did; and little if any goes unquestioned. For the abolition of the draft, in particular, Mr Friedman could claim some credit: a surprise, perhaps, to those who saw him as a right-wing ideologue. Conscription—“an army of slaves”, as he put it to William Westmoreland, the army chief of staff—was illiberal: in peacetime, there was no justification for not hiring volunteers at a market wage.

Soon after becoming president, Richard Nixon set up a commission, on which Mr Friedman sat, to examine the argument for abolishing the draft. (Nixon had already been persuaded that it should go.) Conscription was ended in 1973, by which time the Vietnam war had anyway turned public opinion against it. Mr Friedman wrote, “No public-policy activity that I have ever engaged in has given me as much satisfaction as the All-Volunteer Commission.”

Second, Mr Friedman revolutionised how economists and policymakers treated money and inflation. Until he showed otherwise, post-war governments seemed able to trade off unemployment and inflation: a long-term statistical link between the two, known as the Phillips curve after the New Zealander who noted it, appeared to prove as much. By loosening monetary policy, governments could apparently buy a reduction in unemployment at the price of a little more inflation.

This, said Mr Friedman, addressing the American Economic Association as its president in 1967, was an illusion. Pumping up demand pushed down unemployment only by fooling workers into thinking that wages had risen relative to prices, making them more willing to offer their labour. Once the truth dawned and they demanded more pay, unemployment would rise back to its “natural” rate. If governments tried to push unemployment below this rate, in the long run they would succeed only in pushing inflation ever higher. Edmund Phelps, winner of this year's Nobel Prize in economics, made a similar observation at around the same time.

Mr Friedman's work was embellished by others, who modelled firms' and workers' expectations in a more sophisticated way. What really counted, though, was that he had spotted a flaw in economic orthodoxy before it was made obvious by events. In the 1970s rich economies suffered rising inflation and higher, not lower, unemployment, despite governments' efforts to inflate their way out of trouble. Mr Friedman said this was futile: governments simply had to adopt a stable monetary framework. By this he meant setting a target for the growth of the money supply, a rule known as monetarism.

His diagnosis of monetary ills and prescriptions for monetary policy long predated that presidential address. In 1963, with Anna Schwartz, he published “A Monetary History of the United States, 1867-1960”, a monumental labour. The book traced a causal relationship between the rate of monetary growth and the price level. Most eye-catching was its analysis of the Great Depression—or, as the authors called it, the Great Contraction.

The American economy shrank so much between 1929 and 1933, they argued, not because Wall Street crashed, because governments put up trade barriers or because under capitalism slumps are inevitable. No: trouble was turned into catastrophe by the Federal Reserve, which botched monetary policy, tightening when it should have loosened, thus depriving banks of liquidity when it should have been pumping money in.

Hence Mr Friedman's mistrust of independent central banks: “To paraphrase Clemenceau, money is too important to be left to the Central Bankers.” He thought they should limit inflation by targeting the rate of growth of the money supply. Aiming for inflation directly, he thought, was a mistake, because central banks could control money more easily than prices.

Brilliant as his monetary diagnoses were, on the details of the remedy he came out on the wrong side. Controlling the money supply proved far harder in practice than in theory (notably in Britain in the 1980s: Mr Friedman grumbled that the British authorities were going about it in the wrong way). These days many central banks are not only independent of government but also have inflation targets—to which, by and large, they get pretty close. The Federal Reserve has even stopped publishing M3, a broad measure of the money supply. Writing in the Wall Street Journal when Alan Greenspan stood down as Fed chairman in January this year, Mr Friedman did admit that he had underestimated central bankers' abilities—or Mr Greenspan's, anyway.

Third, Mr Friedman laid the foundation of modern theories of consumption. Keynes had posited that as income rose, so would the proportion that was saved. Economic data bore this out only up to a point: though the rich had higher saving rates than the poor, aggregate saving rates did not rise as countries became richer.

Mr Friedman resolved this apparent paradox with a theory known as the permanent income hypothesis, set forth in 1957. People, he suggested, did not spend on the basis of what their income happened to be that year, but according to their “permanent income”—what they expected to have year in and year out. In a bad year, therefore, they might dip into their savings; when they had a windfall, they would not spend the lot. He called the hypothesis “embarrassingly obvious”; but in hindsight, many of the best ideas are. It was good enough, with his work on monetary analysis and stabilisation policy, to win him a Nobel Prize in 1976.

Getting fellow economists to accept your ideas is one thing; transmitting them to the laity in plain English is another. He was a gifted communicator, like many prominent economists from Keynes to Paul Krugman. For 18 years he had a column in Newsweek. He and Mrs Friedman wrote a bestselling book, “Free to Choose”, published in 1980, based on a television series of the same name. Mrs Friedman, whom he met when they were graduate students in Chicago, was a fine economist too and a sharp editor of her husband's work. She survives him after 68 years of marriage.

Politicians were keen to listen—most obviously Ronald Reagan. Although Mr Friedman met Margaret Thatcher and her government's policies bore a monetarist mark, she was probably influenced more directly by Hayek than by him. Mr Friedman was heartened by Reagan's willingness to support the Fed's tight monetary policy in the early 1980s and by his pro-market, small-government instincts, borne out in less regulation and the tax reform of 1986. He was disappointed by developments after Reagan left office. He would have preferred Donald Rumsfeld, not George Bush senior, as Reagan's vice-president and successor. An appraisal of the Rumsfeld presidency must be left to counterfactual historians.

His most controversial listener was neither Reagan nor Lady Thatcher, but Augusto Pinochet. The Chilean dictator combined ruthless repression with a taste for free markets and monetarism. In the latter, he was advised by the “Chicago boys”, economists educated at the university where Mr Friedman was the leading light. He thought they had the economics right, but insisted that his own connection with Chile was much exaggerated by those who took him to task at demonstrations and in print. In 1975 he spent six days there, met General Pinochet once and wrote to him afterwards with his economic prescription—a conclusion, he believed, that the Chicago boys had already reached.

If Mr Friedman had a favourite economy, it was Hong Kong. Its astonishing economic success convinced him that although economic freedom was necessary for political freedom, the converse was not true: political liberty, though desirable, was not needed for economies to be free. Why, he asked, had Hong Kong thrived when Britain, which controlled it until 1997, was so statist by comparison? He greatly admired Sir John Cowperthwaite, the colony's financial secretary in the 1960s, “a Scotsman...a disciple of Adam Smith, his ancient countryman”. And how much more, Mr Friedman wondered, might America have thrived had it kept its government as small, relative to its economy, as the island entrepot had done?

| |

| |

That lament showed that Mr Friedman, brilliant and influential though he was, did not win all the fights he picked. Far from it. Education vouchers, which he and Mrs Friedman pushed for many years, have gained intellectual respectability but made limited headway in practice. Government spending, as a share of GDP, did not budge much even under Reagan and is much as it was when he left office. Only last month, Mr Friedman worried in the Wall Street Journal that greater state intervention in Hong Kong would mean that the place “would no longer be such a shining example of economic freedom.”

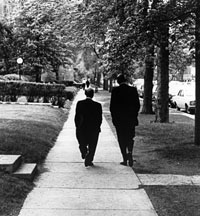

Rent control, the subject of that “drivel” in 1946, is still being argued over, not least in New York City. Should you be curious about Mr Friedman's co-author, look at the photograph above. Towering next to Mr Friedman is George Stigler, the Nobel economics laureate in 1982: friends and colleagues, they stroll on the Chicago campus, no doubt discussing how to make the world a freer and happier place.

|

Copyright © 2006 The Economist Newspaper and The Economist Group. All rights reserved. |